2022美国各州消费税一览!了解你在的州地方消费税,综合消费税情况!

时间:2022-04-06 来源: 作者: 我要纠错

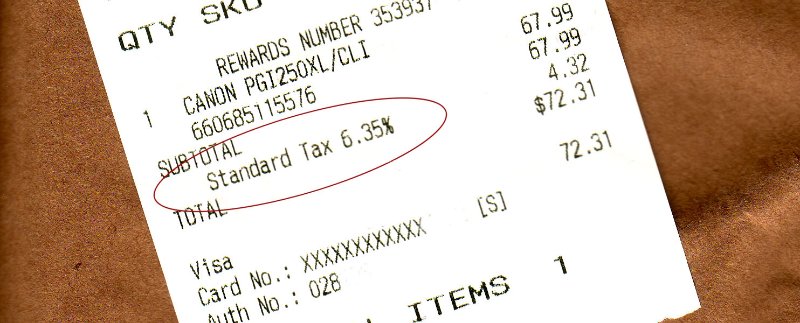

在美国购物消费,超终所花费的价格和购买时标签上所标注的价格是并不一样的,这是因为在美国各地消费时,会根据不同地点的消费税税率收取消费税,一起来了解一下2021年超新的美国各州消费税情况!

美国消费税

在美国的各州中,免税州分为5个(阿拉斯加免州消费税,部分地区收取地方消费税)

- 俄勒冈州 Oregon

- 特拉华州 Delaware

- 蒙大拿州 Montana

- 新罕布夏州 New Hampshire

- 阿拉斯加州 Alaska (部分)

我们平时购物结账时所支付的税费通常为综合消费税,即Combined Sales Tax,这是由每个州固定的州消费税(State Sales Tax) + 不同地区的地方消费税 (Local Sales Tax)而组成,这也就造成了即使在同一个州里面不同地区的消费税不同的情况。另外,有很多州的州消费税并不高,但是地方消费税极高,所以综合消费税也飙升。比如说像是加州,虽然州消费税排名全美第一高达7.25%,但是在综合了地方消费税之后,综合消费税就仅排名第9了。

| 2021美国各州消费税 | ||||

| 州 | 州消费税 | 平均地方消费税 | 综合消费税 | 综合消费税排名 |

| Tennessee | 7.00% | 2.55% | 9.55% | 1 |

| Louisiana | 4.45% | 5.07% | 9.52% | 2 |

| Arkansas | 6.50% | 3.01% | 9.51% | 3 |

| Washington | 6.50% | 2.73% | 9.23% | 4 |

| Alabama | 4.00% | 5.22% | 9.22% | 5 |

| Oklahoma | 4.50% | 4.45% | 8.95% | 6 |

| Illinois | 6.25% | 2.57% | 8.82% | 7 |

| Kansas | 6.50% | 2.19% | 8.69% | 8 |

| California | 7.25% | 1.43% | 8.68% | 9 |

| New York | 4.00% | 4.52% | 8.52% | 10 |

| Arizona | 5.60% | 2.80% | 8.40% | 11 |

| Missouri | 4.225% | 4.03% | 8.25% | 12 |

| Nevada | 6.85% | 1.38% | 8.23% | 13 |

| Texas | 6.25% | 1.94% | 8.19% | 14 |

| New Mexico | 5.125% | 2.71% | 7.83% | 15 |

| Colorado | 2.90% | 4.82% | 7.72% | 16 |

| Minnesota | 6.875% | 0.59% | 7.46% | 17 |

| South Carolina | 6.00% | 1.46% | 7.46% | 18 |

| Georgia | 4.00% | 3.32% | 7.32% | 19 |

| Ohio | 5.75% | 1.48% | 7.23% | 20 |

| Utah | 6.10% | 1.09% | 7.19% | 21 |

| Florida | 6.00% | 1.08% | 7.08% | 22 |

| Mississippi | 7.00% | 0.07% | 7.07% | 23 |

| Indiana | 7.00% | 0.00% | 7.00% | 24 |

| Rhode Island | 7.00% | 0.00% | 7.00% | 24 |

| North Carolina | 4.75% | 2.23% | 6.98% | 26 |

| North Dakota | 5.00% | 1.96% | 6.96% | 27 |

| Iowa | 6.00% | 0.94% | 6.94% | 28 |

| Nebraska | 5.50% | 1.44% | 6.94% | 29 |

| New Jersey | 6.625% | -0.03% | 6.60% | 30 |

| West Virginia | 6.00% | 0.50% | 6.50% | 31 |

| South Dakota | 4.50% | 1.90% | 6.40% | 32 |

| Connecticut | 6.35% | 0.00% | 6.35% | 33 |

| Pennsylvania | 6.00% | 0.34% | 6.34% | 34 |

| Massachusetts | 6.25% | 0.00% | 6.25% | 35 |

| Vermont | 6.00% | 0.24% | 6.24% | 36 |

| Idaho | 6.00% | 0.03% | 6.03% | 37 |

| D.C. | 6.00% | 0.00% | 6.00% | 38 |

| Kentucky | 6.00% | 0.00% | 6.00% | 38 |

| Maryland | 6.00% | 0.00% | 6.00% | 38 |

| Michigan | 6.00% | 0.00% | 6.00% | 38 |

| Virginia | 5.30% | 0.43% | 5.73% | 41 |

| Maine | 5.50% | 0.00% | 5.50% | 42 |

| Wisconsin | 5.00% | 0.43% | 5.43% | 43 |

| Wyoming | 4.00% | 1.33% | 5.33% | 44 |

| Hawaii | 4.00% | 0.44% | 4.44% | 45 |

| Alaska | 0.00% | 1.76% | 1.76% | 46 |

| Delaware | 0.00% | 0.00% | 0.00% | 47 |

| Oregon | 0.00% | 0.00% | 0.00% | 47 |

| Montana | 0.00% | 0.00% | 0.00% | 47 |

| New Hampshire | 0.00% | 0.00% | 0.00% | 47 |

图片来自于@ ,版权属于原作者

由此可见,田纳西州虽然州消费税不算高,但是平均的地方消费税加上以后,综合消费税居然跃居全美第一名!

小总结

美国各州的消费税结构也并不相同,比如德州购买生肉蔬菜等等都是不收取消费税的,日常的生活开支也能节省不少!